All Categories

Featured

Table of Contents

An additional kind of advantage credit ratings your account equilibrium regularly (every year, for example) by setting a "high-water mark." A high-water mark is the highest possible worth that a mutual fund or account has gotten to. The insurance company pays a death benefit that's the greater of the existing account value or the last high-water mark.

Some annuities take your preliminary investment and automatically add a specific percentage to that amount annually (3 percent, for example) as an amount that would be paid as a survivor benefit. Lifetime payout annuities. Beneficiaries then get either the real account value or the first investment with the annual rise, whichever is higher

As an example, you might pick an annuity that pays for 10 years, yet if you pass away prior to the one decade is up, the remaining payments are assured to the recipient. An annuity fatality advantage can be useful in some situations. Right here are a couple of examples: By helping to stay clear of the probate procedure, your beneficiaries might get funds quickly and conveniently, and the transfer is private.

How do I cancel my Annuity Accumulation Phase?

You can generally select from numerous alternatives, and it's worth checking out every one of the alternatives. Choose an annuity that works in the means that finest assists you and your family members.

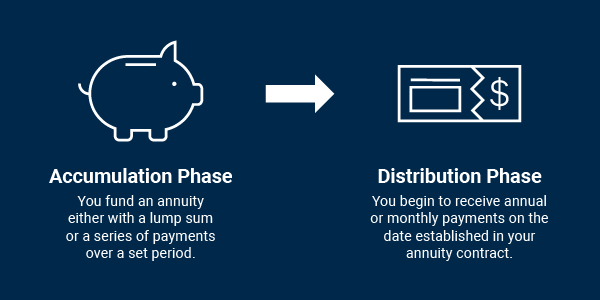

An annuity assists you collect money for future income needs. The most appropriate use for earnings settlements from an annuity agreement is to fund your retired life.

This material is for informational or academic objectives just and is not fiduciary investment recommendations, or a safeties, financial investment method, or insurance coverage product recommendation. This product does rule out a person's own goals or conditions which should be the basis of any kind of financial investment choice (Annuity riders). Financial investment items may go through market and other danger elements

What is included in an Fixed-term Annuities contract?

All guarantees are based upon TIAA's claims-paying capability. Senior annuities. TIAA Typical is a guaranteed insurance contract and not a financial investment for government securities regulation functions. Retired life repayments refers to the annuity earnings obtained in retirement. Warranties of repaired month-to-month payments are only connected with TIAA's taken care of annuities. TIAA may share earnings with TIAA Standard Annuity proprietors with declared extra amounts of interest during accumulation, higher preliminary annuity income, and through additional boosts in annuity revenue benefits during retirement.

TIAA may provide a Commitment Incentive that is only readily available when choosing lifetime income. Annuity agreements might consist of terms for maintaining them in pressure. TIAA Typical is a fixed annuity item provided with these contracts by Teachers Insurance policy and Annuity Organization of America (TIAA), 730 Third Opportunity, New York, NY, 10017: Kind collection including but not restricted to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8.

Transforming some or all of your financial savings to income advantages (referred to as "annuitization") is a long-term choice. As soon as revenue advantage settlements have started, you are incapable to alter to one more alternative. A variable annuity is an insurance policy contract and consists of underlying investments whose value is tied to market performance.

What does an Annuity Accumulation Phase include?

When you retire, you can choose to get earnings for life and/or various other revenue choices. The actual estate sector goes through numerous threats consisting of changes in underlying building worths, expenses and income, and prospective ecological responsibilities. Generally, the worth of the TIAA Realty Account will certainly rise and fall based on the underlying value of the straight realty, genuine estate-related financial investments, actual estate-related safety and securities and fluid, set income investments in which it spends.

For a more complete conversation of these and various other risks, please seek advice from the prospectus. Responsible investing incorporates Environmental Social Administration (ESG) aspects that may impact exposure to issuers, industries, industries, limiting the type and number of investment chances offered, which can lead to omitting financial investments that carry out well. There is no guarantee that a diversified profile will certainly enhance general returns or outperform a non-diversified profile.

Aggregate Bond Index was -0.20 and -0.36, respectively. Over this same duration, relationship between the FTSE Nareit All Equity REIT Index and the S&P 500 Index was 0.77. You can not invest directly in any type of index. Index returns do not show a reduction for charges and expenses. Various other payout alternatives are available.

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

There are no charges or costs to start or quit this function. It's important to note that your annuity's balance will certainly be minimized by the earnings settlements you receive, independent of the annuity's efficiency. Income Test Drive revenue settlements are based upon the annuitization of the quantity in the account, period (minimum of ten years), and other aspects picked by the individual.

Where can I buy affordable Fixed Indexed Annuities?

Any kind of warranties under annuities provided by TIAA are subject to TIAA's claims-paying ability. Transforming some or all of your savings to earnings advantages (referred to as "annuitization") is a permanent choice.

You will certainly have the option to call numerous beneficiaries and a contingent recipient (someone designated to obtain the cash if the main recipient dies prior to you). If you don't call a beneficiary, the collected assets can be surrendered to a banks upon your death. It is very important to be aware of any kind of economic effects your recipient might deal with by acquiring your annuity.

Your partner could have the choice to transform the annuity agreement to their name and come to be the brand-new annuitant (known as a spousal continuation). Non-spouse beneficiaries can not proceed the annuity; they can only access the marked funds. Minors can not access an inherited annuity till they turn 18. Annuity continues can leave out a person from receiving federal government benefits - Lifetime payout annuities.

Is there a budget-friendly Variable Annuities option?

For the most part, upon fatality of the annuitant, annuity funds pass to an appropriately called beneficiary without the delays and costs of probate. Annuities can pay death benefits a number of different means, depending upon terms of the agreement and when the fatality of the annuitant happens. The alternative selected influences exactly how taxes are due.

Choosing an annuity recipient can be as facility as selecting an annuity in the first place. When you speak to a Bankers Life insurance coverage representative, Financial Agent, or Investment Consultant Representative that offers a fiduciary requirement of treatment, you can rest assured that your choices will certainly aid you build a plan that provides safety and security and peace of mind.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments Key Insights on Variable Vs Fixed Annuity Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Fixed Income Annuity Vs Va

Breaking Down Indexed Annuity Vs Fixed Annuity Key Insights on What Is A Variable Annuity Vs A Fixed Annuity Defining Variable Annuity Vs Fixed Annuity Pros and Cons of Fixed Vs Variable Annuity Why C

Breaking Down Your Investment Choices A Closer Look at Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of Fixed Income Annuity Vs Variable Annuity Features of Smart Investment Choices

More

Latest Posts