All Categories

Featured

Table of Contents

On the various other hand, if a customer requires to provide for a special needs youngster who might not have the ability to manage their own cash, a trust fund can be included as a beneficiary, enabling the trustee to manage the circulations. The sort of beneficiary an annuity owner chooses influences what the recipient can do with their acquired annuity and exactly how the profits will certainly be exhausted.

Many contracts allow a spouse to determine what to do with the annuity after the owner dies. A spouse can change the annuity agreement right into their name, assuming all policies and rights to the initial agreement and postponing instant tax obligation repercussions (Lifetime income annuities). They can accumulate all continuing to be payments and any kind of death advantages and choose recipients

When a spouse comes to be the annuitant, the spouse takes over the stream of settlements. Joint and survivor annuities likewise permit a named recipient to take over the contract in a stream of repayments, instead than a swelling sum.

A non-spouse can just access the assigned funds from the annuity owner's preliminary agreement. In estate planning, a "non-designated beneficiary" describes a non-person entity that can still be named a beneficiary. These include depends on, charities and various other companies. Annuity owners can choose to assign a trust fund as their beneficiary.

Where can I buy affordable Long-term Care Annuities?

These differences assign which recipient will certainly receive the whole fatality advantage. If the annuity owner or annuitant passes away and the primary beneficiary is still to life, the main beneficiary gets the fatality benefit. If the primary recipient predeceases the annuity proprietor or annuitant, the fatality advantage will certainly go to the contingent annuitant when the proprietor or annuitant passes away.

The proprietor can change beneficiaries at any kind of time, as long as the agreement does not need an irrevocable beneficiary to be named. According to experienced factor, Aamir M. Chalisa, "it is essential to recognize the significance of assigning a recipient, as choosing the wrong beneficiary can have severe repercussions. Most of our clients choose to name their underage youngsters as beneficiaries, commonly as the key beneficiaries in the lack of a partner.

Owners who are married must not assume their annuity automatically passes to their spouse. When selecting a beneficiary, think about elements such as your partnership with the individual, their age and how acquiring your annuity might affect their economic situation.

The beneficiary's connection to the annuitant generally determines the rules they follow. For instance, a spousal beneficiary has more alternatives for handling an inherited annuity and is treated more leniently with tax than a non-spouse recipient, such as a youngster or various other family participant. Fixed-term annuities. Mean the proprietor does determine to call a youngster or grandchild as a beneficiary to their annuity

How does an Retirement Income From Annuities help with retirement planning?

In estate planning, a per stirpes classification defines that, should your beneficiary die before you do, the beneficiary's descendants (kids, grandchildren, and so on) will certainly get the fatality benefit. Link with an annuity professional. After you have actually picked and named your recipient or recipients, you have to proceed to review your choices at the very least annually.

Maintaining your classifications up to date can make sure that your annuity will be taken care of according to your wishes should you pass away unexpectedly. A yearly evaluation, significant life events can trigger annuity proprietors to take another appearance at their recipient choices. "Someone might want to update the beneficiary designation on their annuity if their life conditions change, such as marrying or separated, having children, or experiencing a fatality in the family members," Mark Stewart, Certified Public Accountant at Action By Action Business, informed To alter your recipient designation, you must connect to the broker or agent who handles your contract or the annuity supplier itself.

Where can I buy affordable Fixed Vs Variable Annuities?

Similar to any kind of monetary product, looking for the help of a financial expert can be helpful. A financial planner can direct you through annuity administration procedures, including the methods for updating your contract's beneficiary. If no recipient is named, the payout of an annuity's fatality benefit mosts likely to the estate of the annuity owner.

To make Wealthtender cost-free for viewers, we make money from advertisers, including monetary professionals and companies that pay to be included. This creates a dispute of rate of interest when we favor their promotion over others. Review our content plan and terms of service to find out more. Wealthtender is not a customer of these monetary companies.

As a writer, it is just one of the very best compliments you can provide me. And though I really appreciate any of you spending some of your hectic days reading what I create, slapping for my write-up, and/or leaving appreciation in a remark, asking me to cover a topic for you absolutely makes my day.

It's you claiming you trust me to cover a subject that is essential for you, which you're certain I 'd do so better than what you can currently discover on the Web. Pretty heady things, and an obligation I do not take likely. If I'm not accustomed to the topic, I research it online and/or with get in touches with who recognize even more concerning it than I do.

What are the tax implications of an Fixed Annuities?

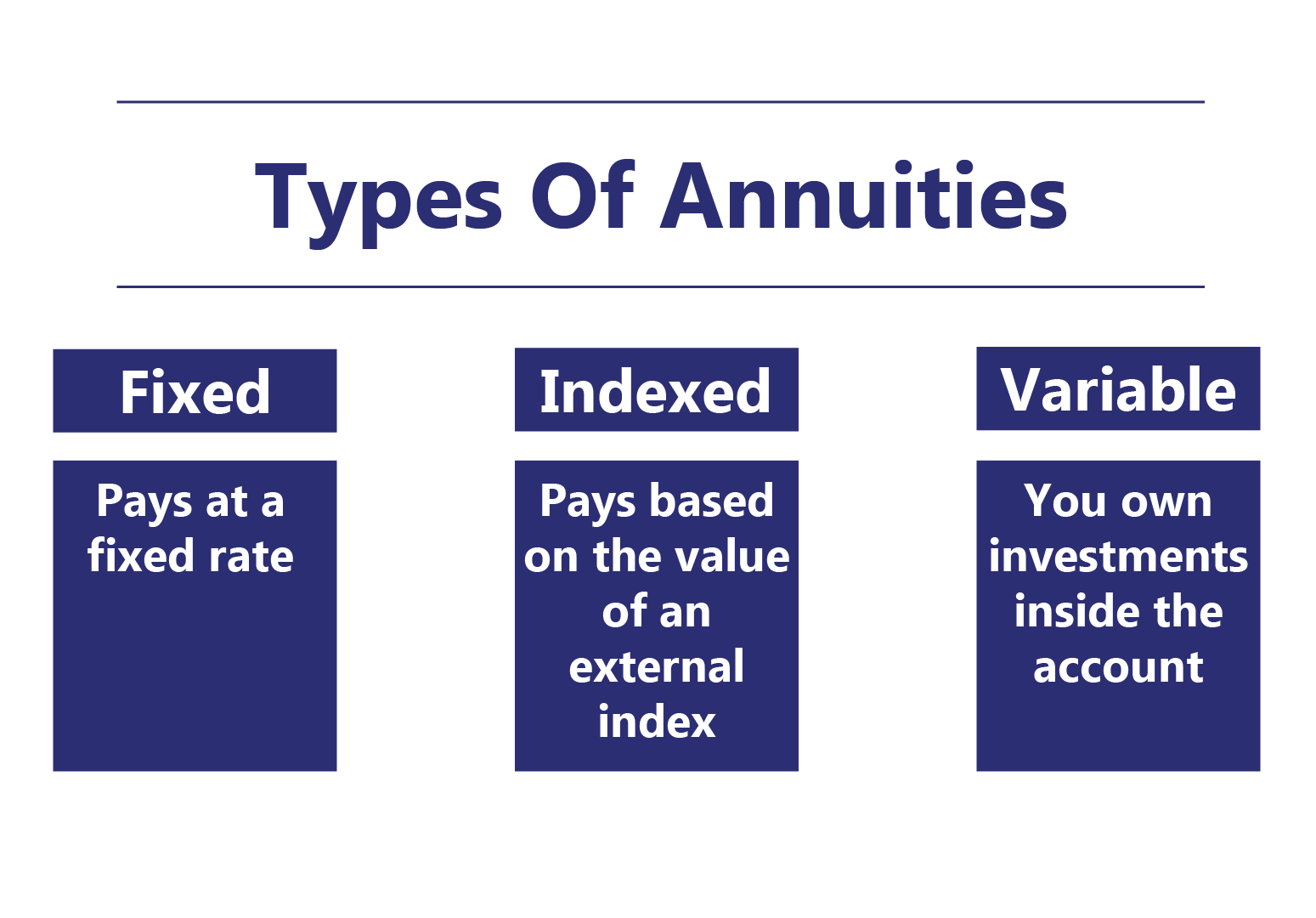

Are annuities a valid referral, a shrewd relocation to secure guaranteed earnings for life? In the easiest terms, an annuity is an insurance item (that just licensed representatives may market) that assures you month-to-month repayments.

How high is the surrender cost, and the length of time does it use? This normally applies to variable annuities. The more cyclists you tack on, and the much less risk you agree to take, the reduced the settlements you must expect to receive for a given premium. The insurance company isn't doing this to take a loss (however, a little bit like a casino site, they're prepared to shed on some customers, as long as they even more than make up for it in higher earnings on others).

How do Fixed-term Annuities provide guaranteed income?

Annuities selected properly are the appropriate selection for some individuals in some circumstances., and then number out if any kind of annuity alternative supplies enough advantages to warrant the prices. I utilized the calculator on 5/26/2022 to see what an immediate annuity may payout for a single costs of $100,000 when the insured and spouse are both 60 and live in Maryland.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments Key Insights on Variable Vs Fixed Annuity Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Fixed Income Annuity Vs Va

Breaking Down Indexed Annuity Vs Fixed Annuity Key Insights on What Is A Variable Annuity Vs A Fixed Annuity Defining Variable Annuity Vs Fixed Annuity Pros and Cons of Fixed Vs Variable Annuity Why C

Breaking Down Your Investment Choices A Closer Look at Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of Fixed Income Annuity Vs Variable Annuity Features of Smart Investment Choices

More

Latest Posts